working two jobs at the same time tax

We will send an updated Tax Credit Certificate to you. You only get one Personal Allowance so its usually best to have it applied to the job paying you the most.

Pin On Make Money From Home Jobs Side Hustle Ideas

The Pay As You Earn PAYE system treats one job as your main employment.

. When you have more than one job you may have the right amount of taxes withheld which will show up on your W-2 but be sure to check that you are withholding the right amount of taxes especially with tax law changes under tax reform. However if your first position falls below your personal allowance your second job tax will generally be set at the standard 20. Make sure you always keep records of the money you earn from both of your jobs.

If you have more than one payer at the same time generally you only claim the tax-free threshold from one payer. This will result in having to write a much smaller check to the IRS when you to file your next tax return. Unless you inform your payroll department that you have a second job both employers will factor in the basic personal amount when deducting tax from your pay.

But watch out for the threshold below for long-term capital gains since it jumps to 20 and with the NIIT youre looking at 238 all-in for Federal and another 93 or 103 for California. Freelancers contractors and sole traders must resolve their own secondary income outside of PAYE. Read your contracts know the law and follow both to.

The takeaway here for the two-job hustler is if you sell your stocks prepare to pay an additional 38 of taxes on top of the usual short and long-term capital gains tax. Two W-2 From Different Employers. If you work two jobs and neither income is above 12570 you can split your Personal Allowance.

Lots of people have two jobs. What to do if you get a second job. If you receive income from two PAYE contracted positions wherein you have an employment contract with one limited company and are the director of your own at the same time HMRC will learn of both of your incomes when they assign your tax codes.

Back To Work Saying. Exhaust Jobs Near Me. Last week the Wall Street Journal reported on a scintillating new remote-work trend.

It appears that white-collar workers in industries from tech to banking to insurance say they have found. This will depend on how much youre paid for each position. If both of your jobs are low paying however you may not have to pay NI at all since you have a second job tax code.

I have a standard office job and I am looking to Uber at the same time. If you entered a W-2 already then click add another W-2. Click search near the top right of the screen and type W-2 then click the Enter key.

Employment applications may be rejected if they are incomplete or do not demonstrate the minimum qualifications required for the position. In summary weve learned that second jobs are taxed but to the same standards as your primary employment. If youre serious about juggling two full-time jobs this means you cant phone it in.

This is called the Personal Allowance and is 12570 for the 202122 tax year. If you had two jobs but not at the same time say one for 5 months a layoff and the next job for 6 months. Although youll have to work out which pay class youre in for each job as well.

If your employee works for someone else you and the other employer should do this separately for each job. See picture attached below However if you already e-filed then you have to wait until the IRS either rejects or accepts your return. Select Jump to W-2 then follow the on-screen prompts.

Working Two Jobs At The Same Time Tax. What To Wear With Ponte Pants. Two jobs tax and National insurance Youll also have to make National Insurance contributions on both jobs if youre paid over a certain amount.

The goal is to be as close as possible to the amount actually withheld and the amount you actually owe in taxes at the end of the year. Outlet Stopped Working. Since you can only apply the basic personal credit once on your tax return you may end up with tax owing.

If you work in two or more jobs at the same time you can divide your tax credits and rate band between jobs. Usually you claim the tax-free threshold from the payer who pays you the highest salary or wage. Revenue will give your tax credits and rate band to that job.

You may receive your income from 2 or more payers at the same time if you. But in practice its anything but straightforward. You then need to calculate the aggregated earnings on 1 of the employees payroll.

Essentially the same credit is being used twice. Have a second job or more than 2 jobs. If you are paid 150 per week in your first job and 100 per week in your second job.

No tax will be paid on the first position as it is under your personal allowance but the second job. If you do not already you should ask your employers to provide you with a paystub every time you. If you have questions regarding your application you can contact Human Resources at 951-922-3147 or hrbanningcagov.

I am curious how am I supposed to file my taxes since one is a standard job and the other I work as an independent contractor. Two-income families taxpayers working multiple jobs should check withholding amount IR-2018-124 May 24 2018 WASHINGTON The Internal Revenue Service urges two-income families and those who work multiple jobs to complete a paycheck checkup to verify they are having the right amount of tax withheld from their paychecks. Do I fill out a W2 form yearly with the total.

They do not count for Personal Allowance unless you ask HMRC to split that between roles yet they can and do raise tax bills overall. Having More Than One Job Low Incomes. I just recently started the office job and plan to start working as a driver in the next few days.

Ideally you should organize these in a spreadsheet - making sure you know your exact income from each job without mixing the two. This will already be handled at your full-time job by your HR department.

Where To Find Tax Preparer Jobs From Home Tax Preparation Online Taxes Tax Prep

New W4 Form Coming For 2employee S Withholding Allowance Certificate Federal Income Tax Printable Chart Data Charts

Today Marks Exactly Two Years Since I Quit My Full Time Job To Become Self Employed Exactly Two Years Ago Work From Home Tips Work From Home Business I Quit

Tax Prep Company Jackson Hewitt Is Filling 22 000 Tax Jobs Tax Prep Tax Season Filing Taxes

Tax Tip How To Claim Work Related Calls On Your Tax Return Tax Return Tax Refund Tax Time

What Is A Rollover Ira How To Transfer Funds From Your 401 K To An Ira And Avoid Taxes Rollover Ira Ira Investment Changing Jobs

6 Ways Federal Income Taxes Will Be Different In 2020 Federal Income Tax Income Tax Tax Deductions

Wondering How To Be More Productive And Get Things Done As A Work At Home Mom Check Out These Five Super Simple Strategies For Maximizing Your Time And Increas

Where To Find Tax Preparer Jobs From Home Tax Preparation Income Tax Preparation Home Party Business

The Pros Cons Of Freelancing Admin Jobs Graduate Recruitment Interview Skills

Work From Home Seasonal Tax Jobs With Intuit Single Moms Income Working From Home Service Jobs Job

Nomisma The Finest Software For Income Tax Computation Accounting Jobs Pinterest For Business Payroll Accounting

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)

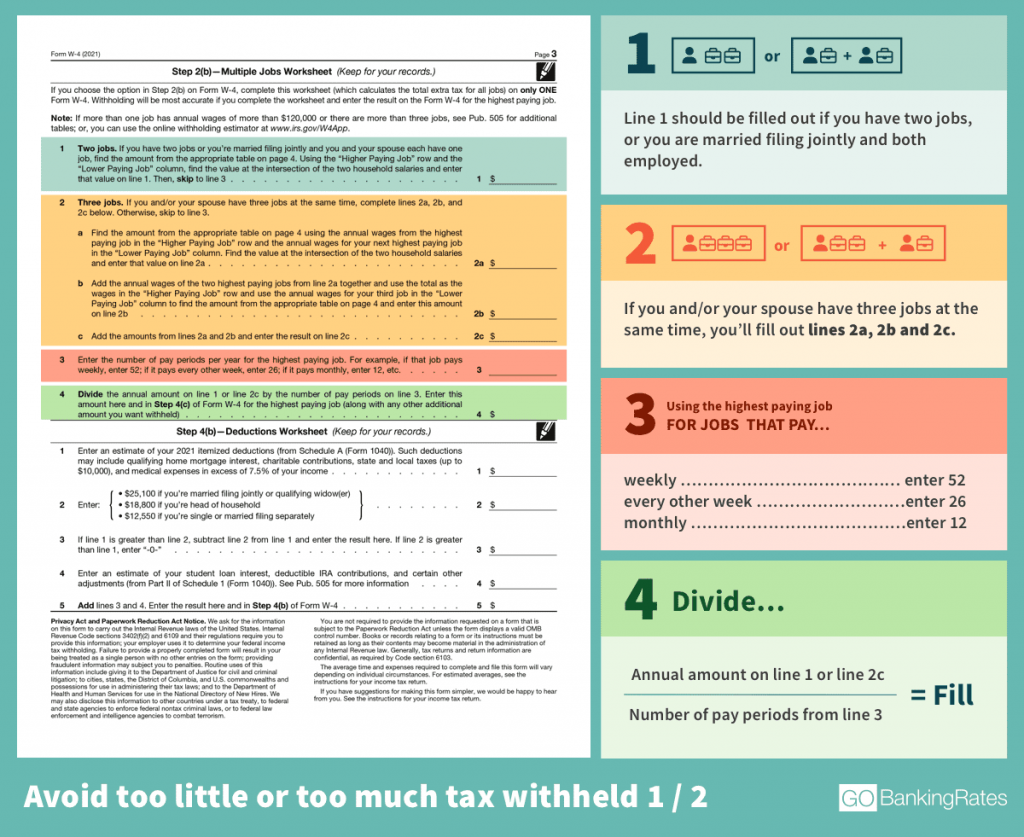

W 4 Form How To Fill It Out In 2022

How To Fill Out A W 4 A Complete Guide Gobankingrates

12 Common Tax Write Offs You Can Deduct From Your Taxes Forbes Advisor

Employer Sponsored Workers Income Tax Financial Statement Audit Services