rhode island income tax nexus

Rhode Island Tax Nexus. The purpose of this regulation is to implement Rhode Island General Laws RIGL Sections 44-11-4 and 44-11-41.

Rhode Island Tax Services Tax Accountants Providence Rhode Island

This amendment provides guidance regarding Nexus for Business.

. Up to 25 cash back Under Rhode Islands business corporation tax as of 2018 C corporation income is taxed at a flat rate of 70. An annual minimum corporate tax of 400 applies to all business entities required to register to do business in Rhode Island including. The Nexus Property Management franchise located in downtown Pawtucket RI has been locally owned and operated since 2013.

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum. Income tax nexus with Rhode Island. Rhode Island Enacts Economic Nexus and Reporting Requirements Provisions.

August 17 2017 register or comply with notice through June 30 2019. July 1 2019. As long as one member in a combined group has corporate income tax nexus with Rhode Island and also engages in activities that exceed the protection of Public Law 86-272 then all.

Nexus means a connection or link with the state sufficient to subject a person to tax by the state as described in 86 of this Part. Rhode Island collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Nexus for the duration of rhode islands coronavirus state of emergency the rhode island division of taxation will not seek to establish nexus for rhode island corporate income tax purposes.

The Rhode Island Income Tax. Corporate income is taxed at a single rate of 7. Businesses with nexus in Rhode Island are required to register with the Rhode Island Department of Taxation and to charge collect and remit the appropriate tax.

Rhode Island recently enacted changes to corporate tax requirements that include updated guidance for corporate nexus combined reporting single sales factor. Rhode Island Corporate Income tax is assessed at the rate of 7 of Rhode Island taxable income. To calculate the Rhode Island taxable income the statute starts with Federal taxable.

Taxpayers in Rhode Island can also claim the credit for child and dependent care expenses equal to 25 of the respective federal credit as well as the earned income credit equal to 15 of. Living up to its reputation as the Property Management. Unlike the Federal Income Tax Rhode Islands state.

Office means a permanent or temporary location. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children. Corporations M N and O all foreign corporations are engaged in a unitary business and are members in the same combined.

Rhode Island collects a state income tax at a maximum marginal tax rate of spread across tax brackets. 4 United States Public Law 86-272 codified at. Also as of 2018 the minimum business corporation tax.

The Rhode Island Income Tax. 3 Rhode Islands corporate income tax is also known as the business corporation tax see Rhode Island General Laws Chapter 44-11. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum.

Unlike the Federal Income Tax Rhode Islands state.

Rhode Island Division Of Taxation 2018 Filing Season Presentation Ppt Download

Anchor Rising Rhode Island Economy Archives

.png)

The Proper Role Of Congress In State Taxation Ensuring The Interstate Reach Of State Taxes Does Not Harm The National Economy Tax Foundation

State Income Tax Law Changes For Q3 Of 2022

Rhode Island R D Tax Credit Summary Pmba

Dissecting The Rhode Island Economic Nexus Sales Tax Sovos

Focus On Rhode Island Miles Consulting Group

Rhode Island Sales Tax Nexus Laws

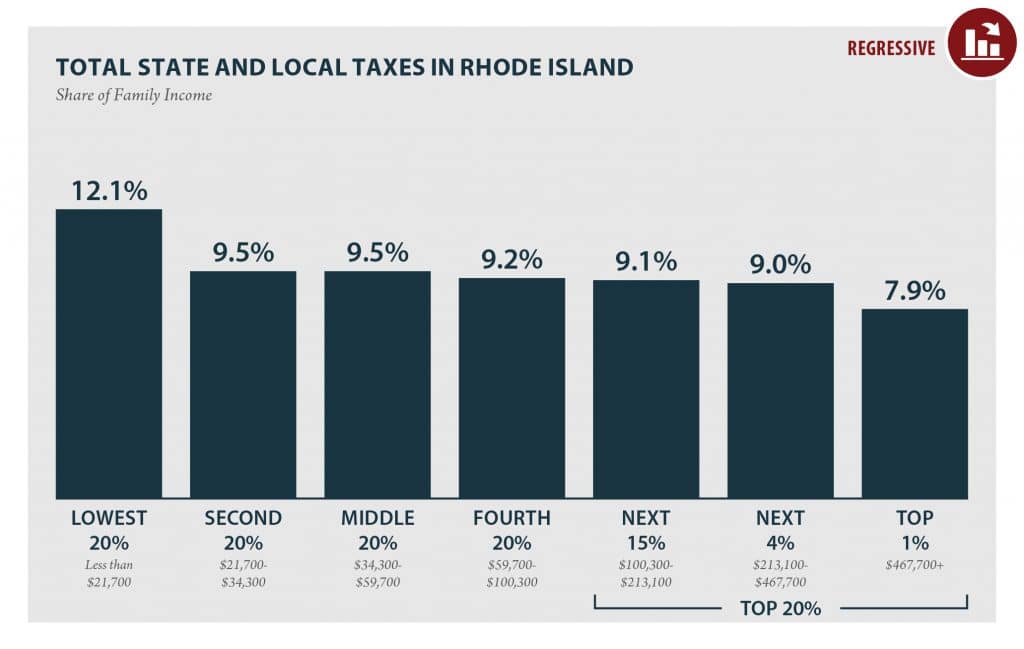

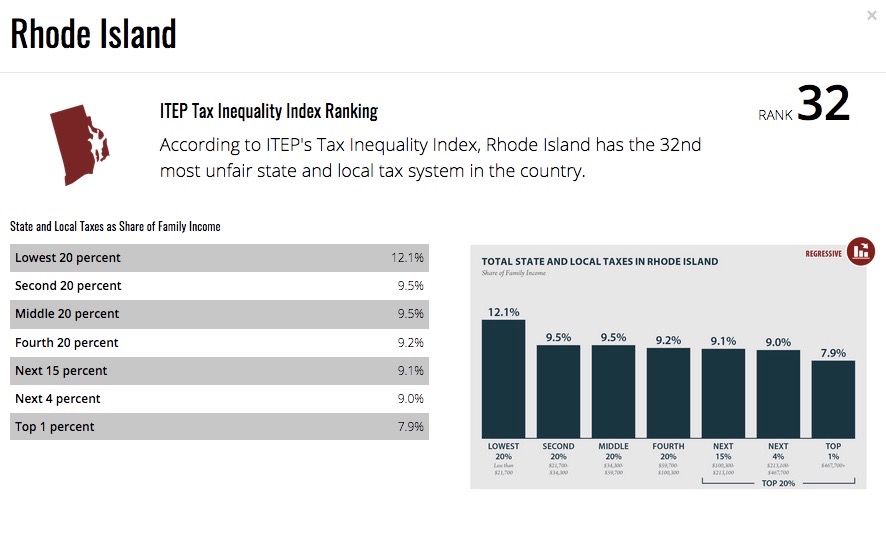

Low Income Taxpayers In Rhode Island Pay Over 50 Percent More In Taxes Than The Wealthiest

Income Tax Nexus Withholding Implications Of Telecommuting Employees During Covid 19 Forvis

5 State Tax Systems State Sales Tax Beyond

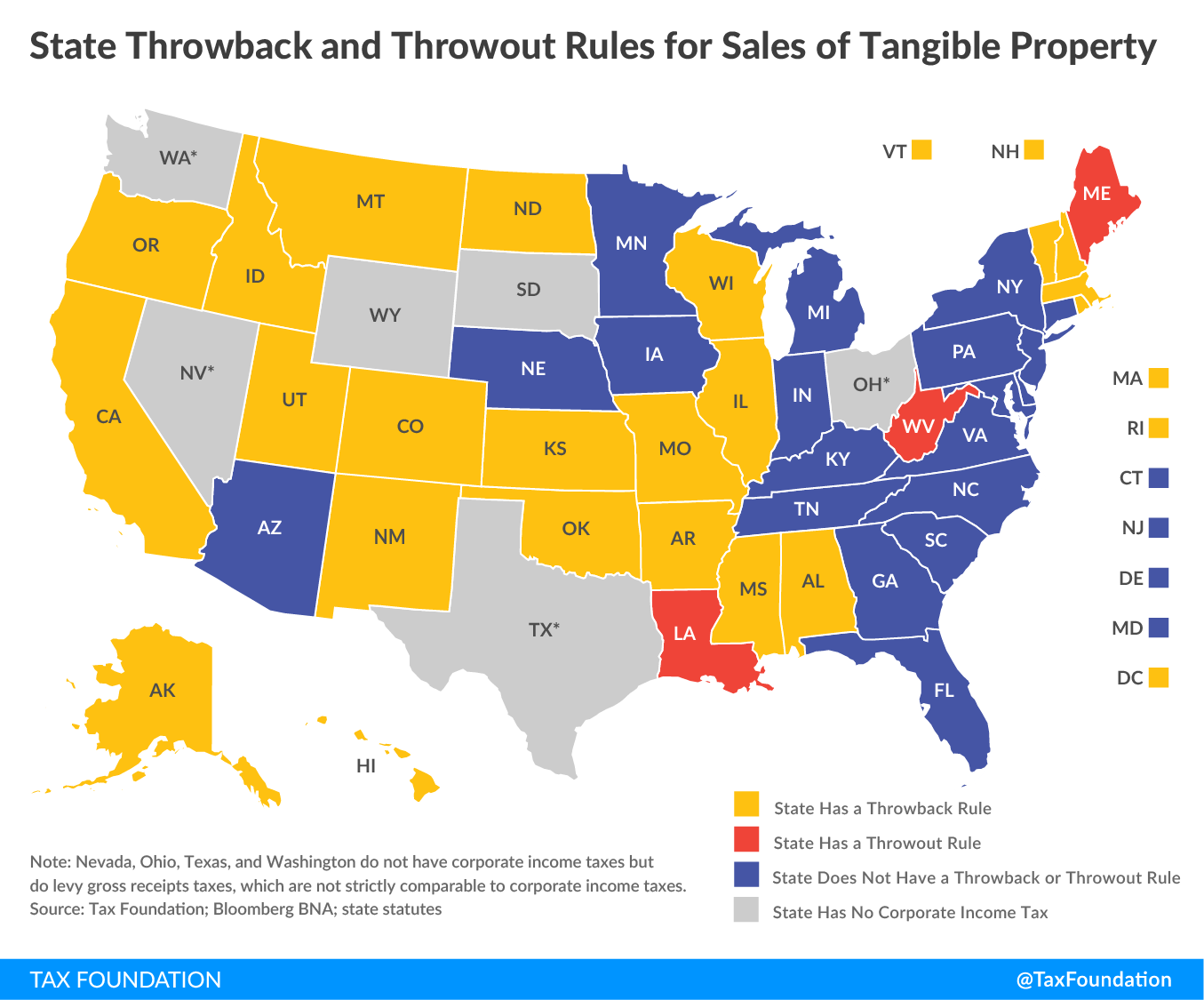

State Throwback Rules And Throwout Rules A Primer Tax Foundation

State Tax Changes In Response To The Recession Center On Budget And Policy Priorities

Rhode Island Division Of Taxation 2018 Filing Season Presentation Ppt Download

Economic Nexus State Chart State By State Economic Nexus Rules Sales Tax Institute

Rhode Island Income Tax Ri State Tax Calculator Community Tax

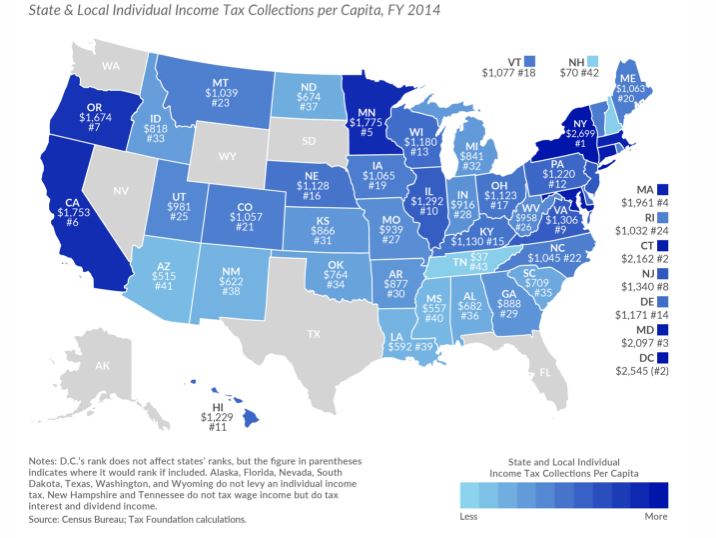

R I State And Local Income Tax Per Capita 2nd Lowest In New England

Low Income Taxpayers In Rhode Island Pay Over 50 Percent More In Taxes Than The Wealthiest