kern county property tax payment

10 a press release from Kern County Treasurer and Tax Collector Jordan Kaufman said. Please enable cookies for this site.

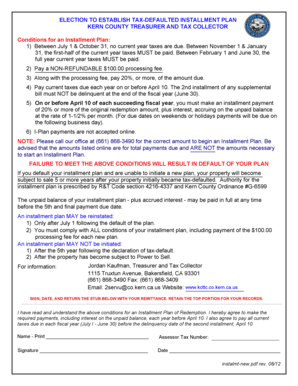

Kern County Treasurer And Tax Collector

Request a Value Review.

. During this time a taxpayer can pay the base taxes due and submit a special COVID-19 penalty waiver request with their payment. The median property tax on a 21710000 house is 227955 in the United States. Taxes - Sample Bill Calculations.

Download the myKentCounty app Today. Look up your property here 2. Within those confines the city sets tax rates.

Secured tax bills are paid in two installments. The special COVID-19 Penalty. Supplemental Assessments Supplemental Tax Bills.

Appropriate notice of any levy increase is another requisite. The Kern County treasurer and tax collector is warning people not to be late otherwise a. Box 541004 Los Angeles CA 90054-1004 PROPERTY TAX RELIEF PROGRAM Are you a homeowner that is behind in your property taxes due to the pandemic.

Get Information on Supplemental Assessments. This unclaimed money consists of Property Tax refunds that require a claim form be submitted prior to the issuance of a warrantcheck. Please contact our office directly at 661 868-3536 for the claim for refund form instructions.

The median property tax on a 21710000 house is 173680 in Kern County. Pay Transfer Tax on an Unrecorded Change in. The all in one app that provides county citizens instant access to a multitude of government services through its modern secure solution utilizing a single login payment methods receipts and official documents.

File an Exemption or Exclusion. Start by looking up your property or refer to your tax statement. Make a payment on a traffic criminal or juvenile dependency case that was previously set up on a payment plan.

Payments can be made on this website or mailed to our payment processing center at PO. Here you will find answers to frequently asked questions and the most commonly requested property tax. Select the property VIEW DETAILS link.

Taxation of real property must. Press enter or click to play code. Obtain a Recorded Document.

The owner search is the best way to find a property. The new property tax deadline for Kern County is May 4 2020. Any payments received or postmarked up to and including May 4 will be processed as a timely payment.

To avoid a 10 late penalty property tax payments must be submitted or postmarked on or before Dec. Office hours are Monday through Friday 800 am. Search for your property.

Search for Recorded Documents or Maps. Change a Mailing Address. The Kern County Treasurer-Tax Collector will present this ACH transaction to your bank for immediate payment.

Purchase a Birth Death or Marriage Certificate. Ad County Of Kern - Pay Your Bill Securely with doxo - The Easiest Way to Pay All Your Bills. Of course exact tax rates vary based on.

This calculator can only provide you with a rough estimate of your tax liabilities based on the. Property Taxes - Assistance Programs. If you inadvertently authorize duplicate transactions for any reason and those duplicate authorizations result in payments returned for insufficient or uncollected funds an additional 27 returned payment fee for each duplicate transaction will be charged.

Send payments via mail to KCTTC Payment Center PO. Kern County Treasurer-Tax Collector mails out original secured property tax bills in October every year. Senate Bill 813 enacted on July 1 1983 amended the California Revenue and Taxation Code to create what are known as Supplemental Assessments.

Ad Request Full and Updated Property Records. The first installment is due on 1st November with a payment deadline on 10th December. Look Up a Home Now.

Box 541004 Los Angeles CA 90054-1004. File an Assessment Appeal. In Kern County the average property tax rate is 08 making property taxes slightly higher than the state average.

You can search for tax bills using either the Assessor Tax Number. Cookies need to be enabled to alert you of status changes on this website. Kerr County Tax Office Phone.

This law requires that any increase or decrease in assessed value due to a change in ownership or completed new construction becomes effective beginning with the first day of. Property Taxes - Pay Online. The median property tax on a 21710000 house is 160654 in California.

The first round of property taxes is due by 5 pm. Please select your browser below to view instructions. Property tax and parcel information are also available on our website.

Look Up an Address in Your County Today. A 10 penalty is. This means that residents can expect to pay about 1746 annually in property taxes.

Please type the text from the image. Search and pay for your Kern County California property tax bill with this service. 1 be equal and uniform 2 be based on current market worth 3 have one estimated value and 4 be considered taxable if its not specially exempted.

Tax Records for Local Properties Have Been Digitized. Download the official app of Kent County Michigan - myKentCounty. The offices of the Assessor-Recorder Treasurer-Tax Collector Auditor-Controller-County Clerk and the Clerk of the Board have prepared this property tax information site to provide tax payers with an overview of the property tax process in Kern County.

Request Copy of Assessment Roll.

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

New Homes For Sale In Chino Hills California Featured Home 7 Quick Move In And 1 Year Hoa Dues Two Stor New Homes For Sale New Home Builders House Styles

Tennessee Land For Sale Best Property To Live In Tennessee Near Lake Acreage For Sale Tennessee Land Lake View Land For Sale

Kern County Treasurer And Tax Collector

Loansigning Complete Customers Refinancing Their Loan For A Lower Interest Rate Metropolitanhome Notary Sign Dates Notary Service

Kern County Property Tax Fill Online Printable Fillable Blank Pdffiller

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Jordan Kaufman Kern County Treasurer Tax Collector Facebook

Pin By Bbb Serving Central California On Bbb Accredited Businesses Fresno County Wood Shop London Property

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

New Homes For Sale In Rosamond California Your Dream New Home In Rosamond 3 Broker Co Op 3 Exci New Home Builders California Modern New Homes For Sale

This Timeline Was Created For The Museum Of The San Fernando Valiey And Pulls From Resources Like Calisphere The Library Of Congress Csun Personal Blogs And A Diverse Set Of Publications Visit

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

The Average Lot Size Of New Single Family Homes Sell Your House Fast Home Home And Family